LuLu Salary Check – Know Your Card Balance Online

Managing your finances effectively begins with understanding how to track and manage your salary conveniently. If you’re an employee receiving your wages through the LuLu Salary Card, this comprehensive guide will detail all the methods available for checking your salary balance and managing your funds seamlessly.

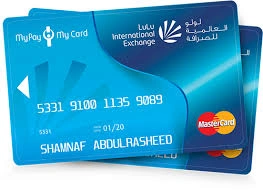

What is a LuLu Salary Card?

The LuLu Salary Card is a prepaid payment solution designed specifically for employees to receive their wages securely and conveniently. The card complies fully with UAE’s Wage Protection System (WPS), allowing employees immediate access to their salaries without requiring a traditional bank account. It operates on the Mastercard network, enabling global acceptance at various merchants, ATMs, and online platforms.

Methods to Check Your LuLu Salary Card Balance

To ensure you have real-time access to your salary information, LuLu provides several easy-to-use methods to check your card balance:

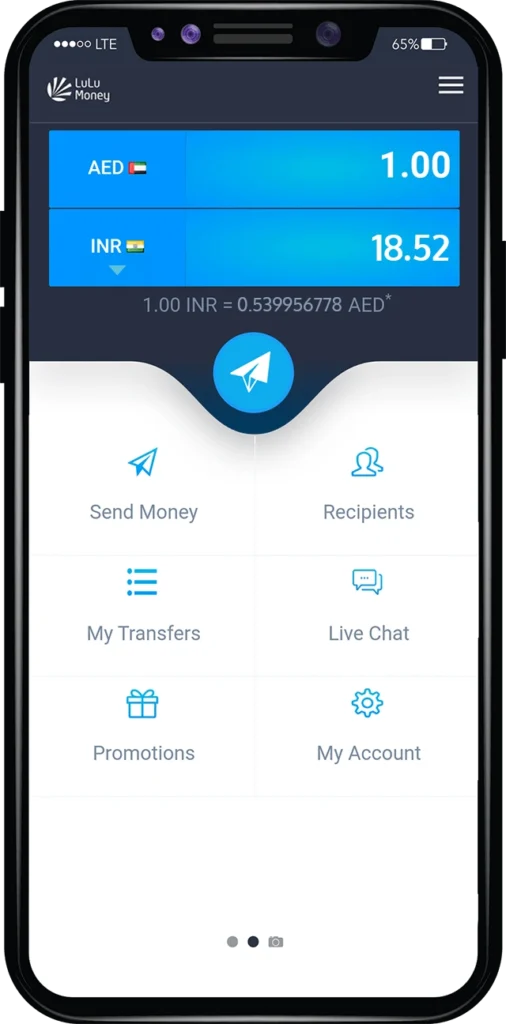

1. LuLu Money Mobile App

The LuLu Money mobile app offers a convenient and comprehensive way to monitor your finances from your smartphone:

- Installation and Setup: The app is available on both Android and iOS platforms. After downloading, register or log in using your account credentials.

- Balance Inquiry: Within the app, navigate to the “My Cards” section to see your current balance, transaction history, and other financial details.

- Additional Features: Utilize the app to set spending alerts, review transaction histories, and access helpful tools for managing your finances effectively.

2. Online Account Access

You can easily access your LuLu Salary Card details online through the official LuLu Money website:

- Access Your Account: Log into your account using your registered username and password.

- Balance Information: Once logged in, the dashboard clearly displays your salary card balance, recent transactions, and other essential account information.

- Account Management: Online access also provides additional functionalities such as downloading statements, updating personal information, and setting up alerts.

3. SMS Balance Inquiry

LuLu offers an SMS service for users who prefer quick access to their balance without internet connectivity:

- Send an SMS: Compose a message with the format

BAL <Your National ID Number>. - Receive Immediate Response: Send the SMS to the designated service number provided by LuLu, and you’ll receive an instant text response detailing your current balance.

4. ATM Balance Check

Another straightforward method is checking your balance at an ATM:

- Using ATMs: Insert your LuLu Salary Card into any compatible ATM.

- Security PIN: Enter your confidential PIN to securely access your account.

- View Balance: Select the “Balance Inquiry” option to immediately display your current available funds on the ATM screen.

5. Visit a LuLu Exchange Branch

For personalized service and detailed account information, visiting a nearby LuLu Exchange branch is highly effective:

- Branch Visit: Locate your nearest LuLu Exchange branch and visit in person.

- Identity Verification: Present your LuLu Salary Card along with valid personal identification.

- Direct Assistance: Receive immediate assistance from LuLu’s customer service representatives who will provide your current balance and help with other account queries.

Advantages of Regular Balance Checks

Regularly monitoring your LuLu Salary Card balance has several important benefits:

- Better Budgeting: Frequent checks help you keep track of your spending and manage your monthly budget effectively.

- Early Fraud Detection: Quickly identifying unfamiliar transactions allows you to report issues promptly, minimizing financial loss.

- Enhanced Financial Planning: Knowing your available funds supports strategic planning for future expenses, investments, or savings.

Conclusion

Effectively managing your LuLu Salary Card is essential for financial stability and security. Whether you prefer using the LuLu Money App, online portals, SMS services, ATM inquiries, or visiting in-person at a LuLu branch, there is a convenient method tailored for everyone’s needs. Stay proactive in managing your finances by regularly checking your LuLu Salary Card balance, ensuring peace of mind and financial clarity.